RPA is automating routine accounting procedures and freeing up accountants’ time for strategic work. RPA improves efficiency, accuracy, data, and compliance. RPA automates data entry, reconciliation, reporting, and auditing in this blog. Join us as we uncover how RPA empowers accountants to be more agile, efficient, and effective in their roles.

Robotic Process Automation (RPA) is changing how accounting software works, and companies of all sizes can benefit from it. RPA is a quick and cheap way to automate routine, repetitive jobs, which frees up time and resources for more important work. With RPA, businesses can simplify their financial processes, and make them more accurate and efficient. cut down on mistakes and inconsistencies, and boost their overall productivity. We’ll talk about how automation is likely to change in 2023. As well as some of the specific benefits of using RPA in accounting tasks. And how businesses can get the most out of this powerful technology.

Automation Trends in 2023

The consumer wants and business strategies are always changing, and businesses need to keep up or risk falling behind. With a bottom line that is getting tighter and tighter, the need for goods and services quickly is greater than ever. How do organizations keep up?

Artificial intelligence has been around for a long time, but business leaders have been slow to use it. This is often because they don’t know what it is. But technology like ChatGPT and other AI tools that are easy to use are making AI more mainstream. And most forward-thinking business leaders know it’s time to use AI.

Organizations shouldn’t invest in AI systems just because they “feel like they should.” Instead, they should look for processes that can be automated from start to finish. Businesses can make sure that automation will be successful in the long run. By making smart investments that can be scaled across the company.

Robotic Process Automation is one way that businesses can use AI. Robotic Process Automation works well with Artificial Intelligence because they both help automate tasks. Artificial Intelligence, or AI, is a broad, all-encompassing word that can be used in many different ways, not just in office technology. Robotic Process Automation is a way to do common, repeatable jobs by making machines act like people. RPA and AI work together to automate every part of your business. This lets you get rid of routine work for your workers and put them to work on more important tasks.

How can RPA be used in Accounting and Finance?

RPA doesn’t replace your ERP or other business software, in fact, RPA can bridge the gap between disparate systems. One use case for RPA can be as simple as taking data from a spreadsheet and entering it into a different software system with zero human intervention.

Robotic Process Automation has clear benefits specifically for distributors. Many of their processes, for example, pricing and promotional updates, must be done manually and can be incredibly tedious work. Typically distributors work with hundreds of brands and thousands of SKUs, each vendor invoice takes time to be processed and when that is multiplied by the number of unique vendors they work with, it can lead to an overwhelming amount of manual processing that needs to be done. Fortunately, Robotic Process Automation can eliminate these frustrating tasks.

One example of Robotic Process Automation being used specifically within the realm of Accounting and Finance. Can be seen through PiF’s customer, Pine State Trading. They are Maine’s leader in the marketing and distribution of beverage products and deliver beer, wine, non-alcoholic beverages, and spirits to a customer base across Maine and New Hampshire. They have also been a customer of PiF Technologies since 2017. By utilizing RPA, Pine State Trading is able to eliminate manual hours. And mistakes commonly associated with hand-entering data.

Accounts Payable, which is a part of accounting, has a lot of jobs that are done the same way over and over again. Most of an employee’s time may be spent sitting in front of a dual monitor and entering data from a spreadsheet into your ERP or another financial system. Instead of relying on people to do these jobs, RPA can automate them and actually make them better.

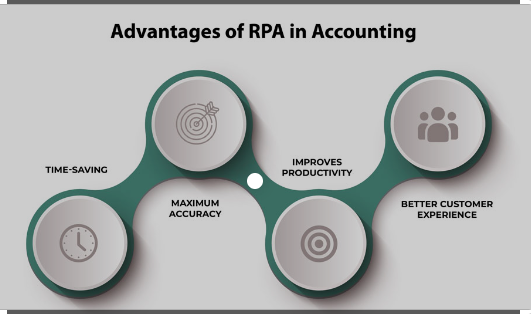

What are the benefits of RPA in Accounting?

Eliminate Manual Data Entry

One of the best things about RPA is that it gets rid of the need to enter data by hand. In accounting, software robots, or “bots,” can be used to do things like copy and paste data from one system to another automatically. By automating these manual data entry tasks. RPA can help to cut down on the time and effort needed to do them and also lower the chance that a person will make a mistake.

By automating manual data entry tasks, RPA can help accounting departments focus on more strategic tasks, improve efficiency and accuracy, and eventually drive business success.

- Eliminate Mistakes

When people are in charge of entering data, mistakes can happen. Data can fall through the cracks even when workers don’t do it on purpose. Even if the data is over 99% accurate, those few mistakes can lead to a lot of work to fix them, which can stop your organization. A huge benefit of RPA is that a bot can never make a mistake. This means that even if you think your processes are “mostly” accurate, adding Robotic Process Automation can move you to 100% accuracy. By automating jobs like data validation and reconciliation, RPA can also help improve the accuracy and consistency of data.

For example, a bot can be set up to compare the data being entered to a set of rules that have already been set up and instantly mark any differences. This can help cut down on mistakes and inconsistencies in the data and improve the general quality of the information being put into accounting systems.

- Reduce the Number of Employees Involved with Accounting Processes

When processes are being completed manually, it often requires a lot of hours of work from your employees. When they’re doing these rote and repetitive tasks, they are often unable to focus on work that helps to grow the organization. In addition, when employees are completing work that isn’t fulfilling mentally or emotionally, which could lead to higher turnover and dissatisfied and disengaged employees.

With Robotic Process Automation, your employees can be relegated to other, higher-value tasks or move into different job functions. Long term, this can provide higher value to your organization and provide stronger job satisfaction to your employees.

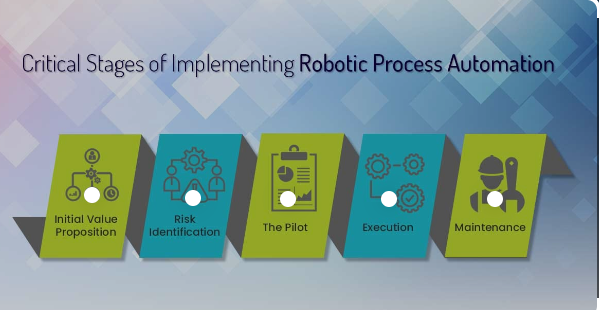

How to implement Robotic Process Automation

The good news is that RPA is now well-known in the mainstream, and automating your processes is easier than ever. Gartner and Forrester’s reports on the technology’s benefits and impact have spread awareness and uptake. Robotic Process Automation might be tough to implement and locate a reliable partner.

It’s vital to comprehend an RPA Consulting Partner’s history in the industry, and the number of projects they’ve performed. And their capacity to provide a client reference about their Partner and RPA technology supplier. PiF Technologies has been deploying RPA technology for more than 10 years and has hundreds of success stories.

Conclusion

Robotic Process Automation (RPA) revolutionizes accounting by automating tasks, enhancing efficiency, and freeing up accountants for strategic work. RPA reduces errors, improves data accuracy, and ensures better compliance. It offers scalability, flexibility, and significant time savings. Successful implementation requires careful planning and addressing challenges. Embracing RPA is essential for organizations to stay competitive in the digital era and empower accountants for a more agile future.

Editor’s Choice:

RPA in Accounting and Finance: 20 Innovative Use Cases

How Robotic Process Automation is Revolutionizing Public Accounting

Transform Your Accounting with Robotics Automation

How RPA Can Improve Efficiency in Accounting Tasks

Top Objections to Robotic Process Automation in Financial Services